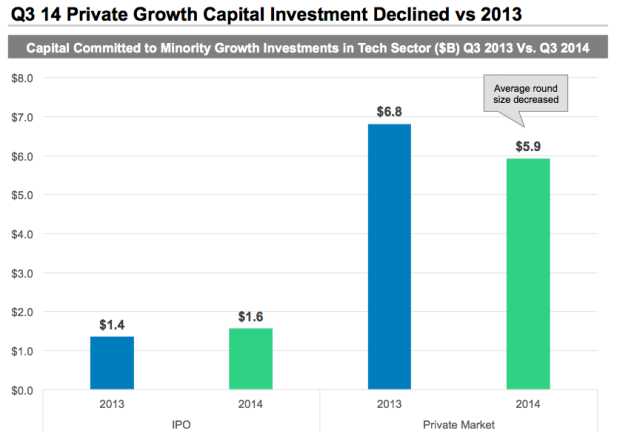

Unicorns and bubble fears are making headlines, but private growth investment in tech actually declined in Q3 relative to the same period last year. The market is still active and healthy. Investment volume increased 18%. However capital committed dropped a bit as average round size contracted from $67M to $50M. Our numbers are growth deals – those over $15M – so it is not intended to capture angel, seed, typical Series A, etc. We track the volume of growth investing in North America and Europe.

Sand Hill Road

Are You Ready to Be a Unicorn?

Joining billion dollar club is a decision to go public

The private financing market is favorable. So much so that we now have Facebook pages set up to count and follow the unicorns – venture-backed companies that have raised capital at valuations above a billion dollars. This is not a bad thing. It means the private market has the depth to finance a company on attractive terms for as long as the Board decides the company should stay private.

The private financing market is favorable. So much so that we now have Facebook pages set up to count and follow the unicorns – venture-backed companies that have raised capital at valuations above a billion dollars. This is not a bad thing. It means the private market has the depth to finance a company on attractive terms for as long as the Board decides the company should stay private.

However, the expansion of available private company valuations has implications a Board and a CEO should consider when pricing the next round. A big step up in valuation means the collective team – leadership, employees and existing investors – are signing up to produce a much bigger outcome.