Market healthy despite Q3 contraction

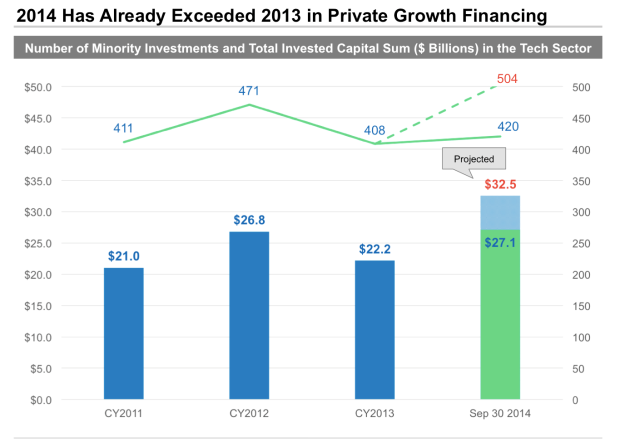

Much-discussed tech bubble fears should be abating as Q3 growth financing activity slowed relative to the first half of the year and the same period last year. CB Insights has relevant data here (Subscribers Only).

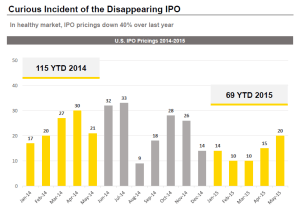

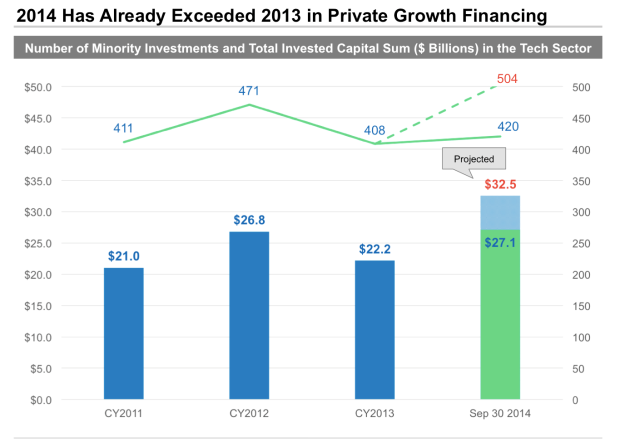

Despite the mild drop in Q3 total capital commitments, CEOs considering raising capital can rely on a private growth market that is still very healthy. The chart above affirms that 2014 investments through September 30th have already exceeded all of 2013 in volume and capital. If Q4 stays on the Q3 pace, the market will have delivered in excess of $32 Billion of growth equity to the tech economy. The private market capital commitment will about equal to the IPO market with the inclusion of Alibaba’s $22Bn largest IPO in history. Normalized to exclude Alibaba, the private growth market in tech will have invested a bit more than 3x the tech IPO market to grow companies in our sector.

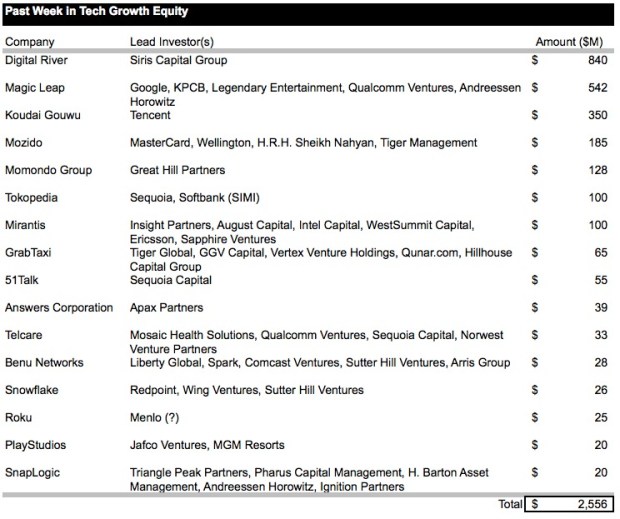

Private investors, traditional, crossover and strategic, continue to deliver capital in round sizes competitive with the IPO market. Halfway through October we have already seen rounds over $100M for Houzz and Docusign and rounds of $60M or more for MetricStream, TrueCaller, Solidfire, Beepi, Alteryx, Good Technology and Minerva Project. Rumors are about that Google may be making a $500M minority corporate venture investment in Magic Leap, a company that has not actually announced a product. Capital in the private markets remains very much available for compelling companies.