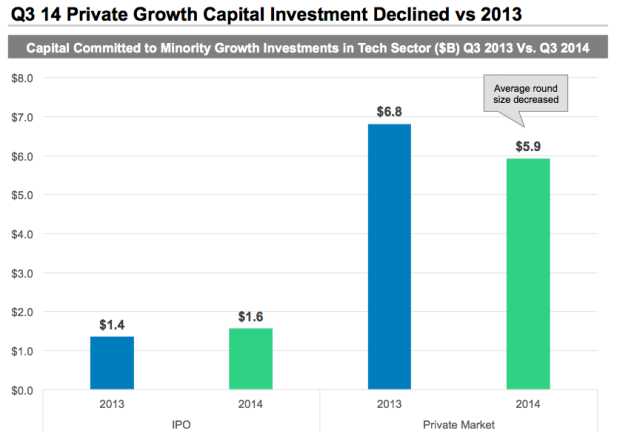

Unicorns and bubble fears are making headlines, but private growth investment in tech actually declined in Q3 relative to the same period last year. The market is still active and healthy. Investment volume increased 18%. However capital committed dropped a bit as average round size contracted from $67M to $50M. Our numbers are growth deals – those over $15M – so it is not intended to capture angel, seed, typical Series A, etc. We track the volume of growth investing in North America and Europe.

Late Stage

Are You Ready to Be a Unicorn?

Joining billion dollar club is a decision to go public

The private financing market is favorable. So much so that we now have Facebook pages set up to count and follow the unicorns – venture-backed companies that have raised capital at valuations above a billion dollars. This is not a bad thing. It means the private market has the depth to finance a company on attractive terms for as long as the Board decides the company should stay private.

The private financing market is favorable. So much so that we now have Facebook pages set up to count and follow the unicorns – venture-backed companies that have raised capital at valuations above a billion dollars. This is not a bad thing. It means the private market has the depth to finance a company on attractive terms for as long as the Board decides the company should stay private.

However, the expansion of available private company valuations has implications a Board and a CEO should consider when pricing the next round. A big step up in valuation means the collective team – leadership, employees and existing investors – are signing up to produce a much bigger outcome.

The Myth of Perfect Timing

Why You Should Raise Money Sooner Rather Than Later

‘Let’s delay the financing. If we wait two quarters we will close a couple of things in the pipeline and will command a higher valuation.’

‘Let’s delay the financing. If we wait two quarters we will close a couple of things in the pipeline and will command a higher valuation.’

The logic seems very solid. However, it’s usually a lousy idea. First, no one can predict the future. You may win two new key customers, but you might also unexpectedly lose two key existing ones. Second, if you are growing well enough to attract capital, the same “wait and get a better price” logic will still apply two quarters from now, delaying your financing in perpetuity.

Still Too Much Investing Happening Close to Home

We thought the “I don’t invest unless I can drive to the company” mantra had left Sand Hill Road a few years ago. The venerable firms have opened offices in outposts like Beijing and Bangalore. Other cities tout their own “Valley-like” ecosystem, the Silicon Alley, Prairie, Roundabout, Beach, Tundra, fill-in-the-regional blank. Coding skills are spreading globally: the TopCoder 2013 Open coding contest included entrants from 152 countries. Incubator spaces sprout like Starbuck’s on every urban corner. Competing in a business plan competition seems to now be a requirement for an undergraduate degree in any discipline.

Yet, a look at the late-stage dollar flow over the past three years suggests investors are creatures of habit. Growth stage investors are piling capital into the companies they know the most about – those that are near offices in Menlo and Palo Alto.