Our friends @Gartner_Inc invited me to speak yesterday at their Annual CEO Summit. I met some interesting people. Two of the speaking Analysts are leading projects around B2B buying processes and behaviors. Gartner has done some interesting analysis here, including creating a framework of Enterprise Buying Personalities. Worth checking out if you are a B2B marketer.

My segment was an update on the Tech Capital Markets generally, and the fundraising environment in particular. The slides from the discussion can be found here.

While reviewing our market data in preparation for the talk a couple of points jumped out at me:

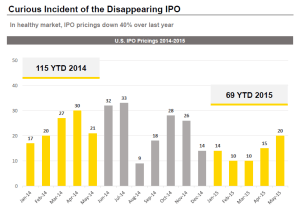

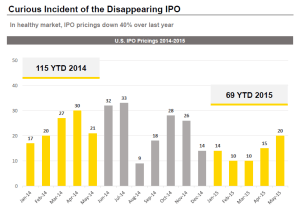

- The IPO market overall, but particularly in tech, is really off this year. Take a look at the data beginning on Page 12 of the deck. Dan Primack forecasted yesterday in his daily post that we are headed for the lowest number of VC-backed IPOs since the 2009 recession.

- Public investors like Fidelity may not be crossing over into the private markets in search of outsized returns. They may be doing it as the lack of tech IPOs is offering them fewer alternatives to add new tech names to portfolios.

- Take a look on Page 22 to see what investors in the latest round for @Snapchat could have bought instead….