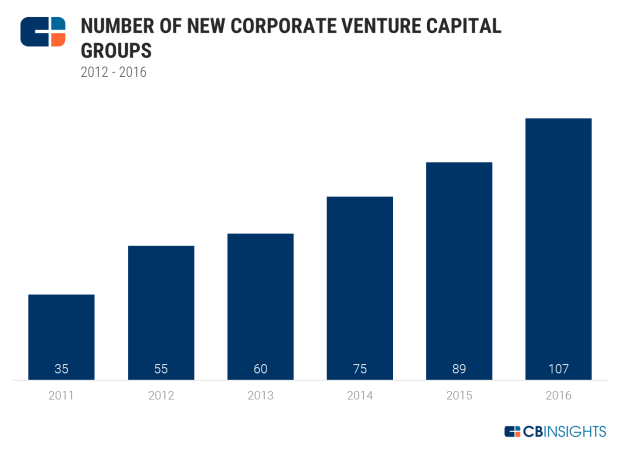

Companies are creating Corporate Venture Capital (“CVC) funds at a healthy pace as shown by CB Insights in the chart below. I suspect a few Fortune 1000 Boards and CEOs are wondering if they should have a fund or if their existing fund is set up correctly. Below is a framework for building a successful team making strategic minority investments.

Start with a clear review of purpose. There are several valid reasons CVC units are formed, but you should be disciplined about the mission of your CVC unit. Some CVC units, like that at Salesforce, are built to create or support an ecosystem around a company platform. Units can be focused on “crowdsourcing” R&D with early stage investments in companies conducting core research to prove product viability. This strategy is very common in the life sciences industry. A CVC can focus on monetizing internal R&D via spin-outs, as practiced by many research hospitals. A CVC team can also be built to seed and diligence a future M&A pipeline as Cisco has done successfully for decades. In some cases, CVC is just a higher ROI use of cash than internal projects or dividends. Whatever the reason, be disciplined about the purpose and avoid building a CVC just because a competitor has one.

Next, be brutally honest in assessing what value you can, and are willing, to deliver to a portfolio company. Cash is a commodity. You will be selling a strategic value such as distribution, assistance in getting to international markets, expertise to scale manufacturing or build a supply chain. This is your value prop and your CVC effort should be organized around delivering it and targeting companies that value it.

Once purpose and value are established, think about scope. Decide if a dedicated fund is the right answer for your company. There are hybrid models like Touchdown Ventures with an outsourced team. There are also narrow funds close to your industry where you might become an LP. If there isn’t one in your industry, consider starting one with institutional or corporate partners. The dedicated fund offers the most impact and control, but it is not the only option.

If you are building a dedicated team, the next issues to consider are sponsorship, structure and staffing. By sponsorship, I mean an internal champion. Successful CVC programs have an internally visible, very senior leader. The leader pushes a large organization to deliver on its value prop to the portfolio. Comcast Ventures is a great example, where company co-founder Julian Brodsky as a senior sponsor could cause the organization to support the portfolio.

The structure reference is primarily to legal structure, but also includes financial commitments and external messaging. Your CVC is most likely to be a syndicate partner, so your structure and messaging need to resonate with your fellow investors. These investors will be most comfortable partnering with something they recognize – a dedicated legal entity with a defined capital commitment. Set up a dedicated entity and get the board to approve a commitment amount that you can announce to the market. The other argument for a separate entity is that it provides some comfort to portfolio companies who can be fearful of sharing an ownership interest in their IP directly with a large, well-funded participant in their market.

When staffing the CVC unit, you need to blend external expertise and credibility with internal relationships and credibility. Sourcing, structuring and supporting a portfolio of start-ups is likely not an internal capability. You should hire externally for the leaders and externally facing executives of the CVC effort. Equally, a group of new hires will struggle to deliver on your value proposition as the new hires lack the internal knowledge and relationships to make the organization responsive to the portfolio. The team needs the capability to source externally and deliver internally, so select your people accordingly. I like what GV, formerly Google Ventures, did in this regard. They had a broad bench of execs that supported the CVC, many on an as-needed basis tuned to their expertise. Making the CVC a portion of an executive’s role is a great way to organize functional support in areas like finance and legal. A dedicated person from the functional unit to support the CVC creates the benefit of a future experience curve without the overhead of full-time resources. Forward thinking CVCs also have a dedicated HR exec, not for HR within the CVC, but as a resource to help the portfolio.

When staffing the CVC unit, you need to blend external expertise and credibility with internal relationships and credibility. Sourcing, structuring and supporting a portfolio of start-ups is likely not an internal capability. You should hire externally for the leaders and externally facing executives of the CVC effort. Equally, a group of new hires will struggle to deliver on your value proposition as the new hires lack the internal knowledge and relationships to make the organization responsive to the portfolio. The team needs the capability to source externally and deliver internally, so select your people accordingly. I like what GV, formerly Google Ventures, did in this regard. They had a broad bench of execs that supported the CVC, many on an as-needed basis tuned to their expertise. Making the CVC a portion of an executive’s role is a great way to organize functional support in areas like finance and legal. A dedicated person from the functional unit to support the CVC creates the benefit of a future experience curve without the overhead of full-time resources. Forward thinking CVCs also have a dedicated HR exec, not for HR within the CVC, but as a resource to help the portfolio.

To attract and retain a staff, you must get the compensation plan right. Dozens of flavors exist, but the effective ones all have some form of “carry”, an explicit connection between investment success and team pay. People with the experience to help build companies have many employment options. Creating a competitive pay plan requires offering upside beyond base salaries. You want the team’s upside tied to results delivered to shareholders, not a bonus for simply making an investment. The upside incentive should also be shared with the internal resources that were key in delivering your value prop to the portfolio. The details of comp plans are a separate long topic, but prepare to connect it to results and find a way to be tax efficient. Your HR department is going to need to think differently for this business unit.

With all the preparation in place, the hard part begins. Below are a few tactics that will make your effort successful once you are in the market:

- Deliver your value prop – The best marketing to prospective portfolio companies is over-delivering for your current portfolio. Be aggressive about it and benchmark your progress with frequent feedback from your CEOs.

- Target a few co-investors – Co-investor relationships are built on a trust that can only be created by working together. Accelerate that process by targeting a handful of core co-investors. Prove your value to these folks, they will become your reference to the rest of the market.

- Embrace speed – Nearly all CVCs make decisions too slowly. They wait for too many levels of approval or a scarce time slot on the CEO’s calendar. Streamline your approval processes and invest in diligence resources to match the market cycle time for syndicate formation and term sheet approval.

- Learn to partner – Big companies can derail small companies when they insist on warping the portfolio company product roadmap and go-to-market plans toward the agenda of the big company. If you need that degree of influence, buy the business rather than invest. Learn to be a minority investor and be mindful that the portfolio companies are not your business units.

I hope the above is helpful. My final advice to those thinking about building or revamping a CVC: Never put a lawyer from your M&A team in charge of the effort. No idea why this gets done, but it does and it’s a direct path to a large write-down.