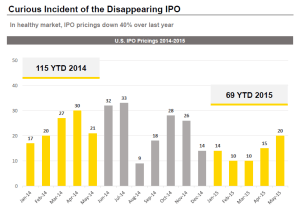

The private market is so healthy that even Silicon Valley journalists are publishing the “B” word (“Bubble”, not the one that rhymes with rich). The robust private market has made the tech IPO an after thought; so much so that we are headed for the lowest issuance since 2009. The chart below highlights how the Unicorn wave is so strong that 41 private companies raised illiquid private rounds ABOVE where Box priced its initial public offering in a liquid market at a very respectable SaaS multiple of about 7.5x run rate revenue.

Are we in a bubble? Journalists are hitting the Wayback Machine and dusting off old S-1s to find Year 2000 metrics we can compare to today’s market to answer the “Bubble / No Bubble” question. In all the looking backward, they might have missed the reality of today’s market.